Smart Lenders

172

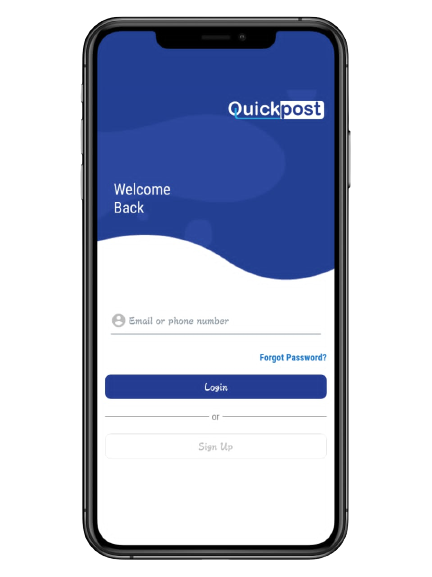

Introducing our newest category, Smart Lenders. Smart Lenders bring their own capital into the system, enabling them to provide loans to customers registered under their accounts. They are a unique addition to the ecosystem, providing additional financial opportunities to borrowers.

Supervisors

10

They play a crucial role in registering customers, managing agents, and overseeing loan processes. These individuals are the backbone of the platform's operations, ensuring a seamless experience for borrowers and agents.

Customers

2285

These individuals and businesses seek financial solutions, including personal and business loans. They are the borrowers who rely on QuickPost for financial support.

Bill Agents

98

These act as intermediaries between Customers and Smart Lenders. They facilitate bills loan applications, deposits, and withdrawals. Agents are the point of contact for customers, ensuring that their needs are met efficiently.